Trust is a prerequisite for a successful and fruitful relationship. That’s as true in business as it is in our personal lives. In both settings, misplacing trust can have disastrous consequences. Today, more than ever, businesses rely on trustworthy supply chain partners to deliver products and services that meet their clients’ expectations.

Failure to do so can have wide-reaching consequences in terms of brand damage. Bad news travels fast, and people are more inclined to become vocal on social media and online review sites to tell the world when something goes wrong than when they have just experienced great service.

Carrying out appropriate due diligence on potential business partners is an internal control measure that cannot be left to chance. We will look at some examples to illustrate just how serious the consequences of failing to do so can be in just a moment.

Supply Chain Due Diligence

Today’s supply chains are complex. They can include suppliers, distributors, agents, consultants, financiers and even customers. Due diligence must be performed both up and downstream, as any external business partner is a potential source of risk.

When we think about due diligence, our minds tend to gravitate towards corruption risk. That is reasonable, and if, for example, you have a business in New York and are considering going into partnership with a distributor in Memphis, it makes sense to run a Tennessee records check to determine if a partner has a criminal history or any other public records that may raise concerns, such as bankruptcy.

However, there are also other due diligence checks that every responsible company should consider making before committing to a relationship with a potential business partner.

Great Minds Think Alike

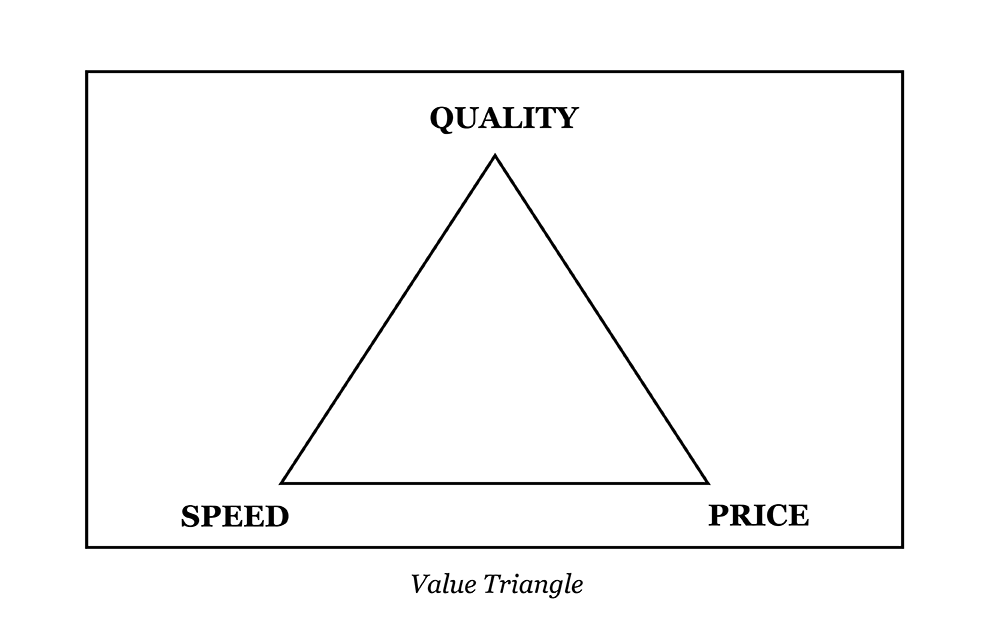

When you partner with another company, it is important that your attitudes and aims are broadly aligned. Every customer wants a high-quality product or service delivered fast and inexpensively, and in an ideal world, that is what every business would like to provide. However, experience and common sense tell us that you can only choose two out of quality, speed and price.

This is sometimes called the value triangle, and businesses typically position themselves on one of the three sides: their strategic focus is on either quality and price, speed and price, or quality and speed.

There is no right or wrong strategy. Many businesses focus on speed and price – just think of some of the most popular fast food chains, for example, where people accept that a cheap burger provided in less than a minute at the drive-through is not going to be of gourmet quality.

However, it is important that when partnering with another business, you share the same basic ethos. Those burger outlets need suppliers and distributors that are aligned with the same priorities.

Look at the Numbers Closely

Financial due diligence looks complex, but with a stepwise approach, you can make it easier. It is vital to understand the financial health of a third party before entering into any kind of business partnership with them. If they are on shaky ground or carrying huge liabilities that could bring them down, it might be better to walk away.

Depending on the type of partnership, you could end up shouldering some of the financial liability if they go under. Even if it is just a simple supplier or distributor arrangement, you need reassurance that they are financially secure and are not on the verge of ceasing trading and causing a breakdown in your supply chain.

Your accountant can request copies of the company’s latest financial statements. You would expect these to be willingly handed over, but if not, the information is usually available online. You don’t have to be a financial genius to understand basic financial statements, and all you need is to see that the business is profitable, has cash in the bank and there are no obvious red flags such as unusually high leverage or a low credit rating.

Entrust the financial due diligence to either an experienced member of your own finance team or your external lawyer, depending on how your business is structured.

Check Supply Chain Tiers

We mentioned earlier that supply chains can be complex. But until something goes wrong, it is not always clear just how complex things truly are. A few years ago, there was a media scandal in the UK and Ireland over horse meat that had found its way into the supply chain and was being sold in ready meals that were supposed to be beef-based.

When they started to dig, KPMG established that there were more than 400 links in some of the supply chains, each of which constituted a potential risk. Now not every business works with supply chains quite as complex as that, but it does serve as an illustration that we need to look at least beyond the end of our noses to the second and third tiers as a minimum.

So to return to our earlier example, if that distributor in Memphis were to take responsibility for the entire Southeast region and were already working with a company in Richmond that could take responsibility for Virginia sales, you would want to run some basic due diligence and at least check Virginia public records for any red flags before blindly agreeing.

Review Industry Trends

Technological advances and other factors such as sustainability are disrupting practically every industry sector to a greater or lesser extent. Sometimes that disruption is positive and sometimes negative. For example, the shift towards electric vehicles is putting huge supply pressure on certain metals that are used in batteries and is driving up prices.

When entering into a partnership with a business in a sector that is related to but distinct from your own, it is important to be aware of industry trends that might have an impact on its future sustainability and profitability. This is the information age, and there is no shortage of industry reports and news articles available online relating to every sector.

Monitor Continuously

Due diligence is sometimes seen as a “set it and forget it” task, a series of boxes to check before you start working with a business partner, supplier or distributor. However, nothing stands still in the business world.

You don’t need to go through the entire due diligence process every year, but it is certainly important to have some form of monitoring. No business’s risk profile is static; it will inevitably change over time. It is important to be aware of any new emerging risks in your supply chain, either directly impacting your partners or at the tier-2 and even tier-3 level.

For example, if that Memphis distributor suddenly contracts with a new agent in Fort Lauderdale who will become responsible for sales in Florida, can he demonstrate that he’s done basic Florida record checks before signing the contract?

Failure To Check – The Consequences

Building a good reputation takes time but can be lost in a moment. When a brand’s reputation is damaged through the actions or inactions of another party, it can be particularly frustrating, but the damage is no less severe.

Let’s look at a few cautionary tales of what can go wrong if you don’t carry out sufficient assessment on existing or potential business partners.

1) Tech giants accused of human rights violations

We touched on the demand for certain precious metals, presenting various risk factors. Cobalt is a prime example, as it is used in lithium-ion batteries. Last year,190,000 metric tons of it were mined, and that number is rising year over year. More than half of all cobalt deposits are mined in Congo.

A lawsuit filed in Washington DC not only claimed that children as young as six are being forced to work in the mines for what equates to a couple of dollars a day. What really grabbed the attention of newspaper readers was not that this could happen so much as that it could happen with the knowledge and even the approbation of companies such as Apple, Dell, Tesla, Microsoft and others.

The defendants would have welcomed the fact that the federal court dismissed the lawsuit, but from a reputation perspective, the damage was already done. The court ruled that the tech giants named could not be held liable due to the multiple degrees of separation, but we can be certain that behind closed doors, every one of them has been tightening up its control mechanisms and due diligence processes in the wake of the scandal.

2) WalMart put the squeeze on its suppliers

As the retailer that sells 25 percent of all the groceries bought in the US, Walmart is a company that every supplier wants to keep happy. It’s an uneven relationship in which the buyer has all the power – but with that power comes responsibility. A report released by the Food Chain Workers’ Alliance (FCWA) a few years ago suggested that it is also a power that can easily be abused.

Not only was WalMart accused of paying lip service to supplier due diligence. It also put such heavy demands on its suppliers that it almost encouraged them to cut corners. The report suggested that WalMart was indirectly perpetuating a range of ethical and regulatory breaches ranging from slave labor at a seafood supplier in Thailand to chemical releases by a food processor in Springdale, Arkansas, just 20 miles down the road from WalMart’s Bentonville headquarters.

3) Target’s data was hacked via an innocent contractor

In 2014, Target suffered a massive data breach in which hackers stole details of around 40 million payment cards from the retailer’s EPOS system. It is one of several high-profile data breaches that happened around that time, but the means by which the hackers gained entry to Target’s systems sound like something straight out of a James Bond or Mission Impossible movie plot.

According to Computer World, Target provided systems access to a third-party contractor, Fazio Mechanical Services, who specialized in HVAC and refrigeration systems. This allowed them to monitor these systems remotely so that they would be alerted to any failures without delay and could take swift action to avoid issues with chilled and frozen food.

Fazio did nothing wrong, but there was an error by omission in that its data security measures were insufficient to protect it from a malware attack or to identify that it had even been hacked. From Fazio’s systems, the hackers were able to get into Target’s systems, and as Target had all systems stored together with no segregation, they were able to navigate from refrigeration and HVAC to EPOS data.

There are all sorts of lessons to be learned here, but for our purposes, the key one is that you should only share such data with third parties as absolutely necessary.

A Great Partnership Can Take on the World

Across every industry, the environment is more competitive and faster-changing than ever before. Businesses need to be agile to stay relevant and that’s something that nobody can achieve in a vacuum.

Strong partnerships and robust supply chains are vital for long-term success. But be aware that they can bring extra risks as well as benefits, so go into every potential new relationship with your eyes wide open.

If you have a chance to procure raw materials at a lower price from a supplier in the Indian subcontinent, check their child labor and employee rights practices. If someone in Dallas says he can triple your sales there, run a background check to see if he has any alarming records in Texas. If a new carrier offers to slash your logistics costs, make sure it is not the last desperate act of a company on the brink of bankruptcy.

Keep these points front and center of your mind, and you will go a long way to preserving the reputation your brand has worked so hard to earn.