Records Page’s resources promote transparency and shed light on what’s considered ethical and responsible use and the rights citizens have if public records are used wrongly, discriminatorily and/or illegally.

This resource provides an overview of the agencies and statutes that govern the utilization of public records in personal and professional settings. However, this information is intended solely for general educational purposes and does not constitute legal advice.

Individuals are encouraged to seek the guidance of legal counsel if their public records are used wrongly, discriminatorily and/or illegally.

This resource has been reviewed by Robert Bailey Jr..

Responsible Use of Public Records

Public records provide transparency, but using them responsibly and legally is contextual as it hinges on their use case and how they’re used.

Personal Uses: The public can access information for personal reasons, provided they’re not violating the stipulations outlined in the Fair Credit Reporting Act (FCRA) or breaking other laws. As an example, citizens have the right to look up:

- Arrests, arrest reports and mugshots

- State and federal prisoners

- Criminal records such as felonies, misdemeanors, other criminal offenses, warrant, probation, parole, (violent, DUI, drug manufacturing and sex) offender registries, mugshots, motor vehicle infractions and more

- Vital records which includes records pertaining to marriage, divorce, common law marriages, palimony or common law divorce, dissolution of marriages and civil unions, births, deaths and archived vital records

- Property records including ownership, taxes, levies and liens

- Judicial records for civil, criminal, family, probate, appellate, bankruptcy and other courts for matters surrounding crimes, marital records, child support, adoption, domestic abuse, small claims, litigations, criminal offenses and more

- Occupational licenses

- Government records such as legislation (bills, statutes, resolutions, meetings and hearings), court documents, budgets, assets, expenditures, property ownership, land and surveying details, environmental impact and inspection reports, federal employee records, government contracts and bids, non-classified correspondence like letters and emails, population statistical data (demographics, economics, and public health) and criminal datasets (demographic and age information of people on parole, probations, types of crimes, locations of crimes and more) for a given region

- Aircraft ownership and registration

- Stock and security trades of large shareholders and politicians

- Tax-exempt organizations such as non-profits, churches and other charitable organization’s financial statements, assets and more

- All other types of public records

With that being said, individuals often look up public records to satisfy curiosity about:

- Neighbors

- Colleagues

- Loved ones

- Roommates

- Public figures

- Potential dates

- What’s on your record

- Current or long-lost friends

- Current, prior and deceased family members

- Vetting online buyers and sellers for personal matters

- Other individuals and entities

Per our Approved & Forbidden Uses page, the records and types of people above may be searched through the resources and services on Records Page. All other uses are prohibited and against the law, as Records Page is not a Consumer Reporting Agency per the FCRA.

Professional Uses (Establishing Eligibility & Credit Worthiness): Public records can be accessed by other entities for professional purposes when establishing an individual’s eligibility or credit worthiness if they obtain the information through a Consumer Reporting Agency and comply with the Fair Credit Reporting Act (FCRA), anti-discrimination statues enforced by the Equal Employment Opportunity Commission (EEOC), the financial laws enforced by the Consumer Financial Protection Bureau (CFPB), and local statutes.

Entities such as potential and current employers, credit card and insurance companies, adoption agencies, volunteer organizations, landlords and licensing boards can access personal information if it’s done through a Consumer Reporting Agency.

They may access people’s personal details if there is a valid need for this information, and they adhere to all federal and local laws, including obtaining written consent.

Irresponsible Use of Public Information

Public records can be accessed for various reasons, but there are stipulations for both use cases to ensure they’re not used illegally or unethically.

If public information was sought out for personal reasons – and used to stalk, intimidate, harass, steal an identity, or commit a crime, local law enforcement agencies should be notified, and violators may be prosecuted under the full extent of the law.

Furthermore, an employer or other entity cannot access the personal public information of a consumer unless it’s done through a Consumer Reporting Agency and adheres to all laws and regulations.

Obtaining and using information to discriminate against a protected class is also prohibited by the Equal Employment Opportunity Commission (EEOC).

If public records were sought out for professional uses or to establish a person’s eligibility credit worthiness – and used to discriminate against someone, this breaks laws that the Equal Employment Opportunity Commission (EEOC) enforces. If public information is accessed through means other than through a Consumer Reporting Agency and used to establish someone’s eligibility or credit worthiness, it’s a violation of the Fair Credit Reporting Act (FCRA).

Fortunately, government bodies and statutes clearly outline what’s acceptable and forbidden and provide resources so citizens can understand their rights and report these matters.

Citizens’ Rights & Protections

No matter the use, public record searches are permissible because of public transparency laws on the federal and state level, and there are rights and protections in place to combat the wrongful use of this information.

Rights & Protections for Personal Uses: Thanks to the federal Freedom of Information Act (FOIA) and associated State-Based Freedom of Information statutes and Public Record Acts, often referred to as sunshine laws, the public has access to citizens’ information through government databases for the sake of transparency.

Information may be accessed for personal reasons out of curiosity and without consent as long as it’s used fairly, responsibly, ethically and abides by federal and local laws.

On the contrary, citizens also have protections to ensure their information isn’t wrongly used, and they possess the right to report these matters in addition to sealing or expunging records in some states.

Rights & Protection When Establishing Worthiness & Eligibility: To ensure information is accessed or used ethically and nondiscriminatory when professional decisions are made, citizens have an abundance of protections in place.

On the federal level, the Equal Employment Opportunity Commission (EEOC) enforces matters surrounding employment discrimination and the Fair Credit Reporting Act (FCRA) – enforced by the Federal Trade Commission (FTC) – protects consumers’ rights when their information is obtained for employment, insurance underwriting, credit and education verification, adoption, vetting in-home services, business transactions and more.

In this context, consumers are individuals undergoing a background check or public record screening, and a Consumer Reporting Agency is an entity that performs background checks to establish peoples’ eligibility and credit worthiness.

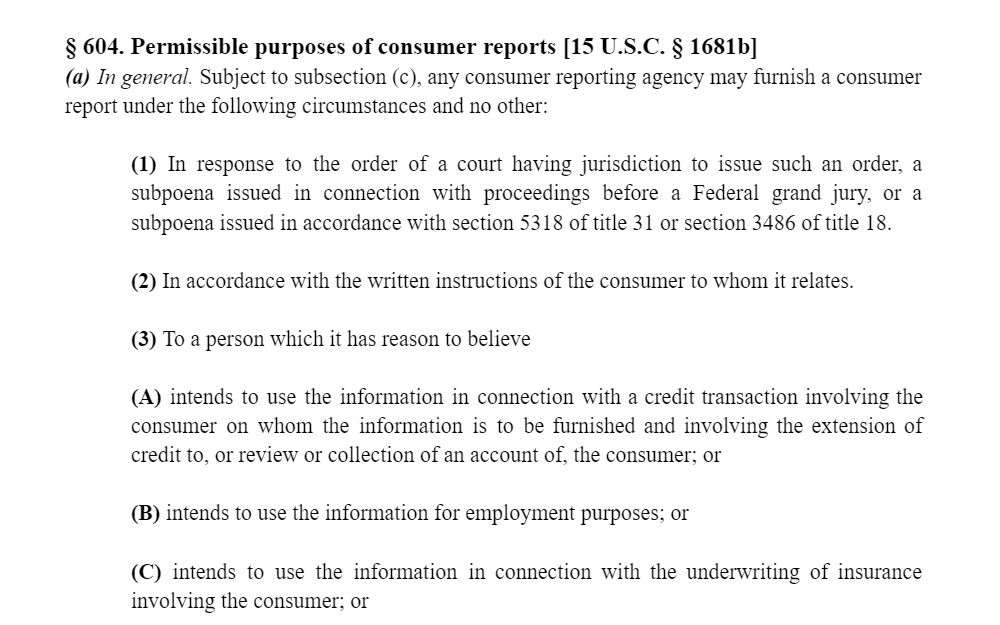

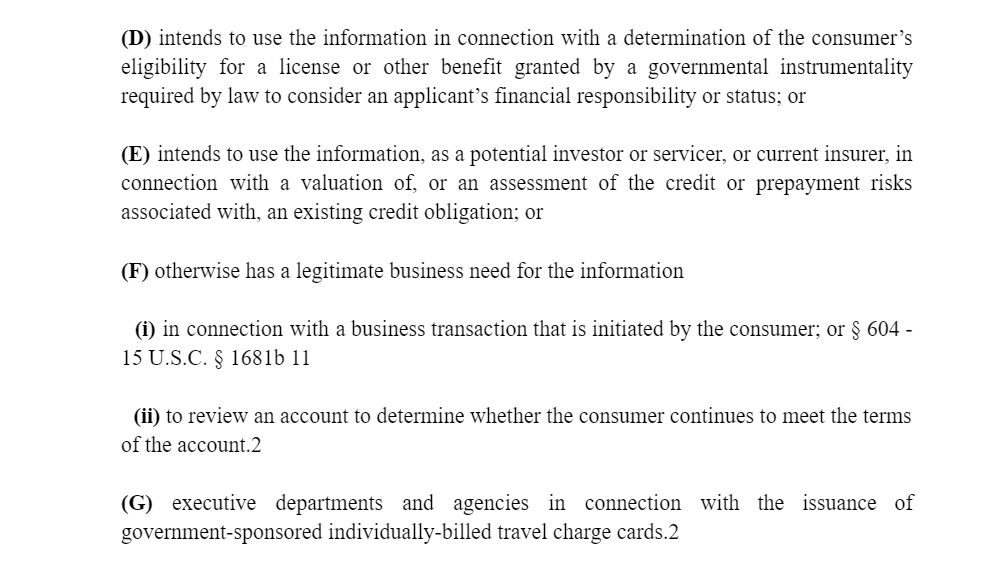

For further context, section § 603 [15 U.S.C. § 1681a] of the Fair Credit Reporting Act (FCRA) defines what a “consumer report” is.

![Section [15 U.S.C. § 1681b] of the Fair Credit Reporting Act which defines what a Consumer Reporting Agency is.](https://recordspage.org/wp-content/uploads/2023/10/Rules-Of-Construction-On-Fair-Credit-Reporting-Act-Screenshot.webp)

![A secondary screenshot of continuation of Section [15 U.S.C. § 1681b] of the Fair Credit Reporting Act which defines what a Consumer Reporting Agency is.](https://recordspage.org/wp-content/uploads/2023/10/Rules-Of-Construction-2-On-Fair-Credit-Reporting-Act-Screenshot.webp)

When a background check or public record screening is performed to establish a person’s eligibility and credit worthiness, Consumer Reporting Agencies and entities who utilize Consumer Reporting Agencies must uphold citizens’ rights and abide by the following stipulations:

- Obtain written consent before providing information to employers (not required in the trucking industry)

- Advise if the information on someone’s file was used against them

- Allow consumers to request the information in their file, along with their credit score

- Permit consumers to dispute inaccurate and incomplete information

- Consumer information that is inaccurate, incomplete or unverifiable must be deleted or corrected within 30 days; in most cases

- Limit reports of most negative information up to 7 and 10 years for bankruptcy

- Ensure the information within consumers’ file are only provided for valid needs

- Provide an option for consumers to opt out or limit prescreened insurance and credit offers based on their credit report

- Allow consumers to freeze their credit or implement a security freeze

Consumers also have the right to seek damages from Consumer Reporting Agencies who violate the conditions set in the FCRA, and identity theft victims and active duty military personnel have additional rights.

Furthermore, employers must treat everyone fairly during applicant screenings and beyond to ensure citizens aren’t discriminated against per the laws the Equal Employment Opportunity Commission (EEOC) and associated agencies enforce.

The EEOC offers resources about employees’ rights regarding background checks, employer stipulations and the Workplace Discrimination Poster that details what employees and employers need to know. The poster further depicts who’s protected, the types of organizations that must comply, which forms of discrimination are illegal and practices that can be challenged.

Filing a Complaint for Misuse or Discriminatory Use of Your Information

With all of this in mind, the following resources allow citizens to report matters of discrimination and the wrongful use and/or access of information on their file to the following agencies:

- Contact Local Law Enforcement – if the information was used for personal matters that involve stalking, intimidation, harassment, and committing crimes

- File a Report With the Equal Employment Opportunity Commission (EEOC) – for matters surrounding discrimination and unethical use of background check information

- Submit a Complaint to the Consumer Financial Protection Bureau (CFPB) – for issues surrounding the wrongful use of credit scores and credit reports

- Submit a Report to the Federal Trade Commission (FTC) – if conditions set forth in the Fair Credit Reporting Act (FCRA) were violated, such as if the information was wrongly used to establish eligibility and credit worthiness regarding employment, housing, insurance, credit, business and investment risks, or other purposes outlined in the ‘Forbidden Uses’ section of our Approved & Forbidden Uses page

These federal protections supersede state statutes, but there are state agencies that may be notified as well.

- Contact State Labor Offices – for fairness in the workplace and employment rights

- Reach Out to State Civil & Human Right Commissions – for matters surrounding discrimination and human rights

- Report Matters to State Licensing Boards – for issues surrounding unethical background check practices when applying for an occupational license

- Get Ahold of State Consumer Protection Agencies & Departments – for violations of the Fair Credit Reporting Act (FCRA), although the Federal Trade Commission (FTC) is the primary enforcement agency

- Attorney Generals in Each State – may assist with consumer protection, legal guidance and deceptive background check practices that violate state laws

While this resource provides an overview of the agencies and statutes that govern the utilization of public records in personal and professional settings, this information is intended solely for general educational purposes and does not constitute legal advice.

If citizens’ public records are used illegally, discriminatorily and/or wrongfully, they are encouraged to seek the guidance of legal counsel.